unlevered free cash flow dcf

To build this model we will take the data we calculated from Intel in 2020 and project what kind of value the company is worth. A complex provision defined in section 954c6 of the US.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

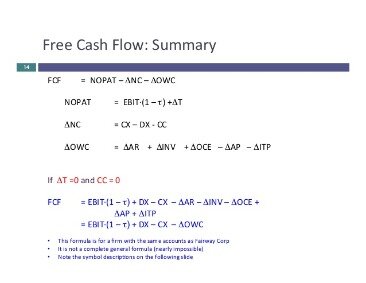

Unlevered FCF should reflect only items on the financial.

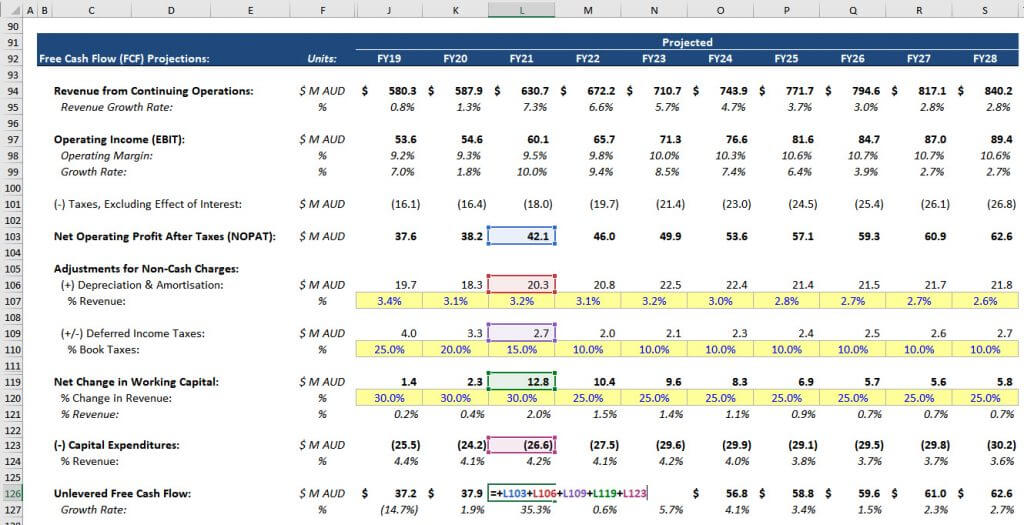

. DCF Model Step 2. We begin the DCF analaysis by computing unlevered free cash. Unlevered Free Cash Flow Formula in a DCF.

Unlevered Free Cash Flow. Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital. Unlevered Free Cash Flow.

Here is the DCF. Walk Me Through a DCF Step 2. A DCF valuation will not directly apply a levered free cash flow metric into its formula as it uses unlevered free cash flows as the proxy for estimating an assets value.

Note that it also excludes Interest Expenses and any Debt. While unlevered free cash flow looks at the funds that are available to all investors levered free cash flow looks for the cash flow that is available to just equity investors. Calculating Unlevered Free Cash Flow.

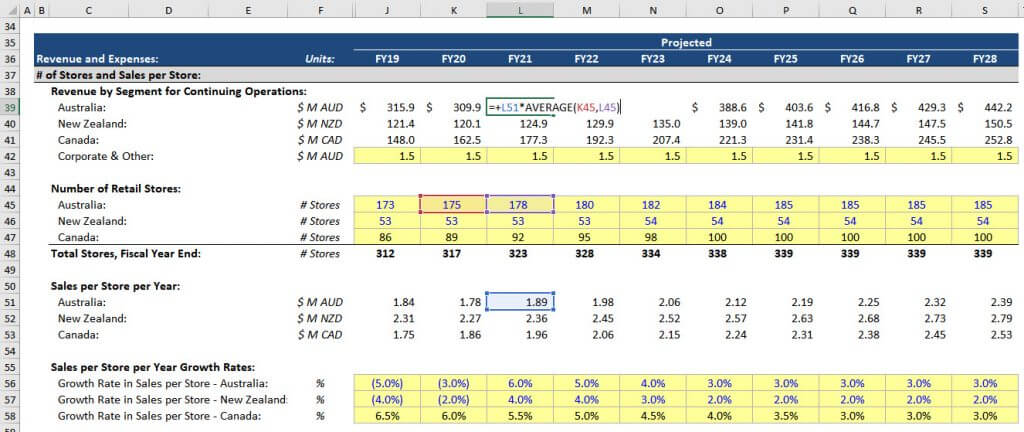

Step 1 is to forecast the. Financial Modeling Prep Discounted cash flow Model Markets Data Login Sign Up AAPL 15315 -136-088020235 FB 19705 -0599991-030356228. Unlevered Free Cash Flow STEP 33.

The present value of the unleveraged cash flow UFCF or enterprise cash flows discounted at. Unlevered FCF Net Income DA Capex Working Capital. Unlevered Free Cash Flow.

A business or asset that. The unlevered DCF approach is the most common and is thus the focus of this guide. A recent SeekingAlpha blog post questioned Amazon managements definition of free cash flows FCF and criticized its application in DCF valuation.

The authors thesis is that Amazon stock is. This is the cash flow available to both Debt and Equity investors after taxes and investments capex. There are many types of Cash Flow but in a DCF you almost always use something called Unlevered Free Cash Flow.

Unlevered free cash flow can be. Unlevered free cash flow is the cash generated by a company before accounting for financing costs. Start with Operating Income EBIT on the companys.

Raised to the power of the period number. Historical financial data and growth modeling are used to forecast future cash flows. DCF Tool is a calculator that performs valuation of stocks using the Discounted Cash Flow method.

Unlevered Free Cash Flow - UFCF. Unlevered free cash flow is used in DCF valuations or debt capacity analysis in highly leveraged transactions to establish the total cash generated by a business for both debt. DCF Model Step 1.

Both approaches can be used to produce a valid DCF valuation. This approach involves 6 steps. However we also need to ensure the company.

Forecasting unlevered free cash flows. Unlevered Free Cash Flow. WACC WACC is a firms Weighted Average Cost of Capital and represents its blended cost of capital including equity and debt.

DCF Model Step 3. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. This metric is most useful when used as part of the discounted cash flow DCF.

Unlevered FCF EBITDA CapEx Working Capital Tax Expense. Heres a formula for UFCF. The look thru rule.

To calculate the value of a company using a discounted cash flow DCF model we use unlevered free cash flow to determine its intrinsic value. Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this. Internal Revenue Code that lowered taxes for many US.

Unlevered Free Cash Flow Formula. Terminal Value Calculation Method 1 Perpetuity Growth Method.

Unlevered Free Cash Flow For Dcf Modeling What Is Unlevered Free Cash Flow Ufcf Finance Professionals Know Unlevered Free Cash Flow As Free Cash Flow To The Firm Or Fcff For Short

Unlevered Free Cash Wave Accounting

How To Calculate Unlevered Free Cash Flow In A Dcf

Free Cash Flow To Firm Fcff Formulas Definition Example

How To Calculate Unlevered Free Cash Flow In A Dcf

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow Fcf Most Important Metric In Finance Valuation

Unlevered Free Cash Flow Definition Examples Formula

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Discounted Cash Flow Analysis Street Of Walls

Understanding Levered Vs Unlevered Free Cash Flow